30+ Debt to income ratio for house

The loans have repayment terms of three to 72 months. In general the lower the percentage the better the chance you will be able to get the loan or line of credit you want.

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

Interest only loans were particularly wound back with approvals limited to 30 per cent of a lenders total loan book.

. A debt-to-income ratio DTI or loan to income ratio LTI is a way for banks to measure your ability to make mortgage repayments comfortably without putting you in financial hardship. Lowering your credit utilization ratio will help boost. Your debt-to-income ratio also determines whether youre eligible for the type of loan you want and improving your DTI can help you get lower mortgage rates.

Save 25X Your Current Income Retirement Savings Ratio. 20 should be immediately saved goals or retirement or put towards paying down debt. Youll then subtract all of your recurring fixed monthly debt obligations and minimum payments on credit cards and other lines of credit.

How To Pay Medical Bills You Cant Afford. Your mortgage property taxes and homeowners insurance is 2000. To calculate your mortgage-to-income ratio m ultiply your monthly gross income by 43 to determine how much money you can spend each month to keep your DTI ratio at 43.

30 is widely considered to be the standard rent-to-income ratio. 20-30-50 Budgeting Ratio. Borrowers with a high DTI ratio may have a high credit utilization ratio which accounts for 30 percent of your credit score.

If youre spending 30 or less of your monthly income on rent then youre most likely in a healthy financial situation. Debt Snowball vs Avalanche. A low debt-to-income ratio demonstrates a good balance between debt and income.

Use this to figure your debt to income ratio. Monthly debt payments monthly gross income X 100 DTI ratio For example your income is 10000 per month. A back end debt to income ratio greater than or equal to 40 is generally viewed as an indicator you are a high risk borrower.

The debt-to-income ratio is an underwriting guideline that looks at the relationship between your gross monthly income and your major monthly debts giving VA lenders an insight into your purchasing power and your ability to repay debt. 30 should be the. When you spend more than 30 of your income on rent you may find yourself limited when it comes to spending on other expenses and putting away money into.

A house and land package loan or. And mortgage lenders will often have in-house caps on DTI ratio that can vary depending on the borrowers. 10X Your Annual Salary Life Insurance Ratio.

As you can see by saving 20 of your income youll hit 25 times your annual income in about 30 years. Age X Pretax Income 10 Net Worth Ratio. For your convenience we list current Redmond mortgage rates to help homebuyers estimate their monthly payments find local lenders.

That means a 30-year-old who starts saving today assuming no prior savings will hit this target by age 60. Most lenders look for a ratio of 36 or less although there are exceptions. But it might give you pause.

Calculate Your Debt to Income Ratio. The budgeting ratio says the order is important. You must earn an after-tax income of at least 1000 per month to be eligible.

Lenders calculate your debt-to-income ratio by dividing your monthly debt obligations by your pretax or gross income.

Pin On Life After College

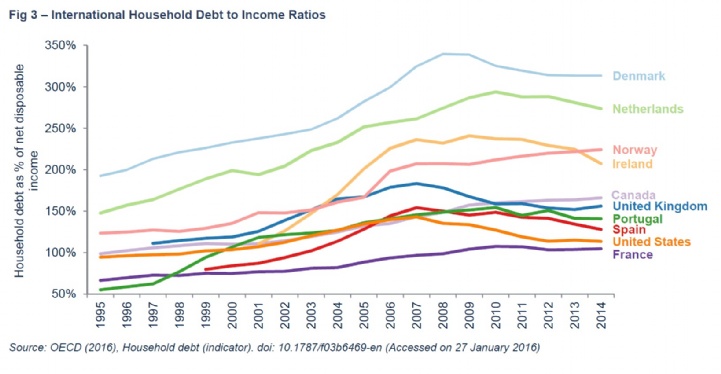

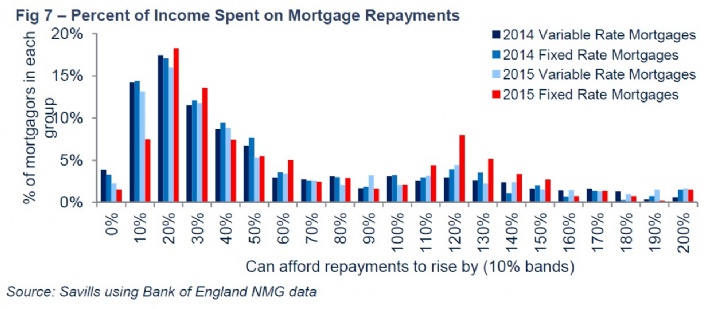

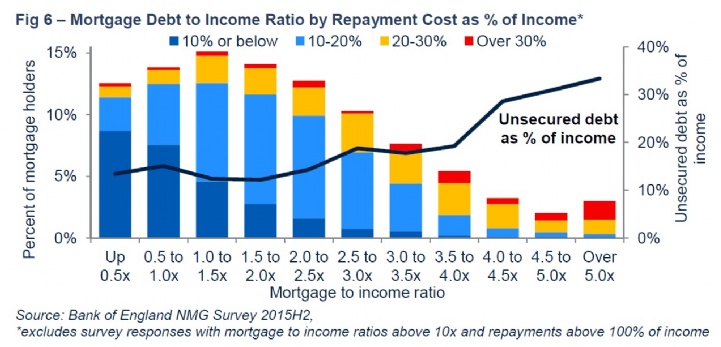

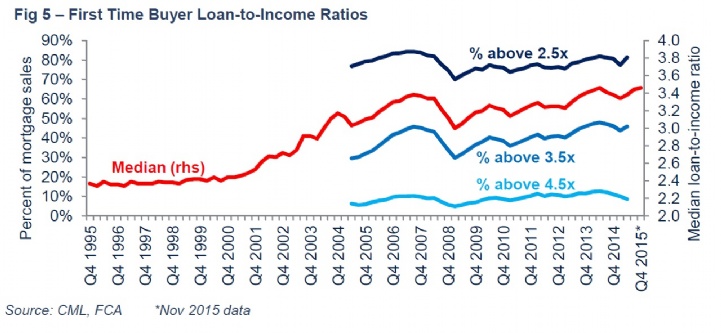

Savills Household Debt

Savills Household Debt

Savills Household Debt

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

Jim Fishinger On Linkedin What Do Mortgage Lenders Look For 1 Creditworthiness Including

Savills Household Debt

Pin On The Bear S Den

.jpg)

Savills Household Debt

What Is The Debt To Income Ratio And Why Is It Important Quora

1 Stop Mortgage First Time Home Buyers Mortgage Real Estate Values

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

What Bills Are Calculated In The Debt To Income Ratio Quora

Business Balance Sheet Template Free Download Balance Sheet Template Statement Template Business Letter Template

Pin On Best Of One Mama S Daily Drama

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

Pin On Airbnb